interest tax shield formula

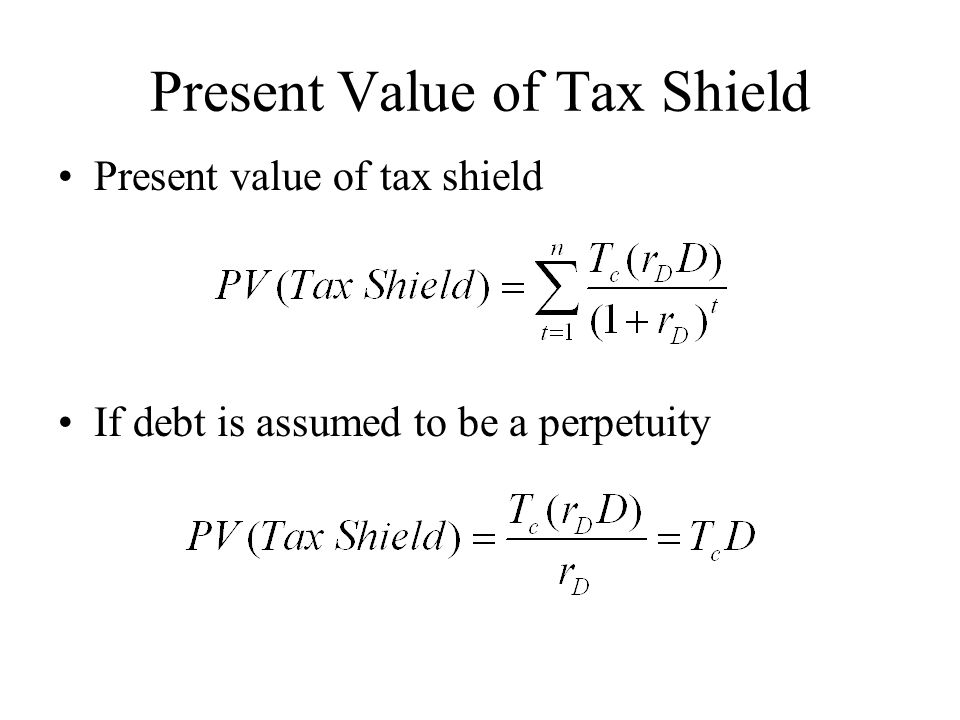

Interest Tax Shield Interest expense Tax Rate. This companys tax savings is equivalent to the interest payment.

Thus if the tax rate is 21 and.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

. How to Calculate a Tax Shield Amount. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Interest Tax Shield Example.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. What is the formula for tax shield. Definition of tax shield.

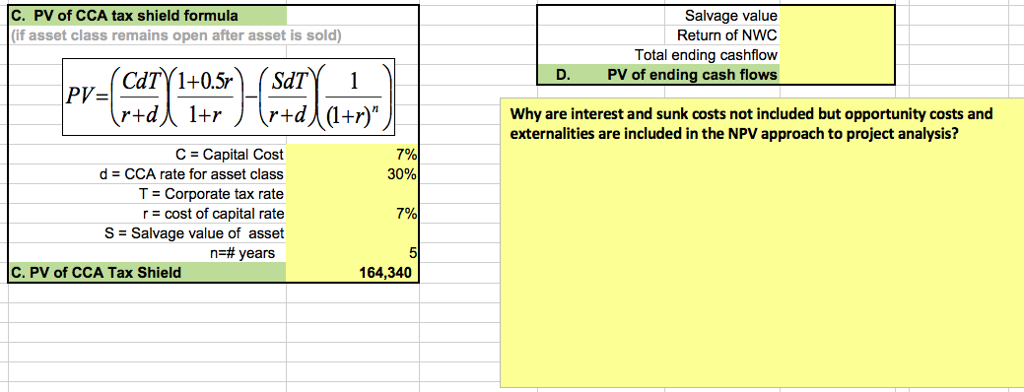

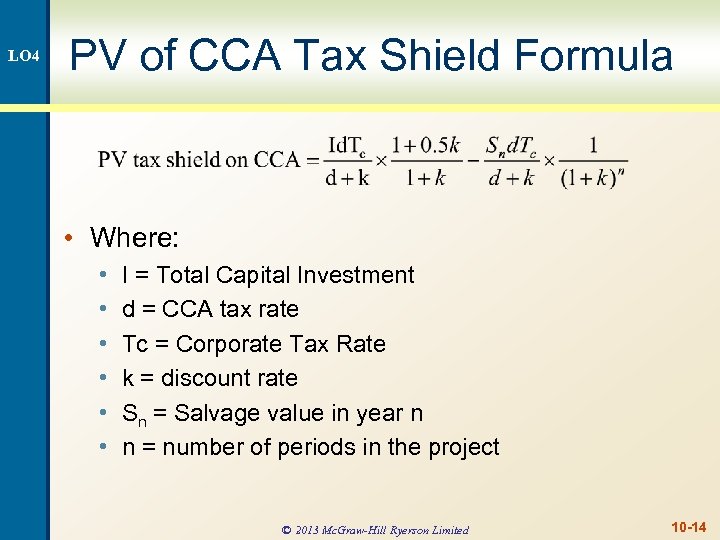

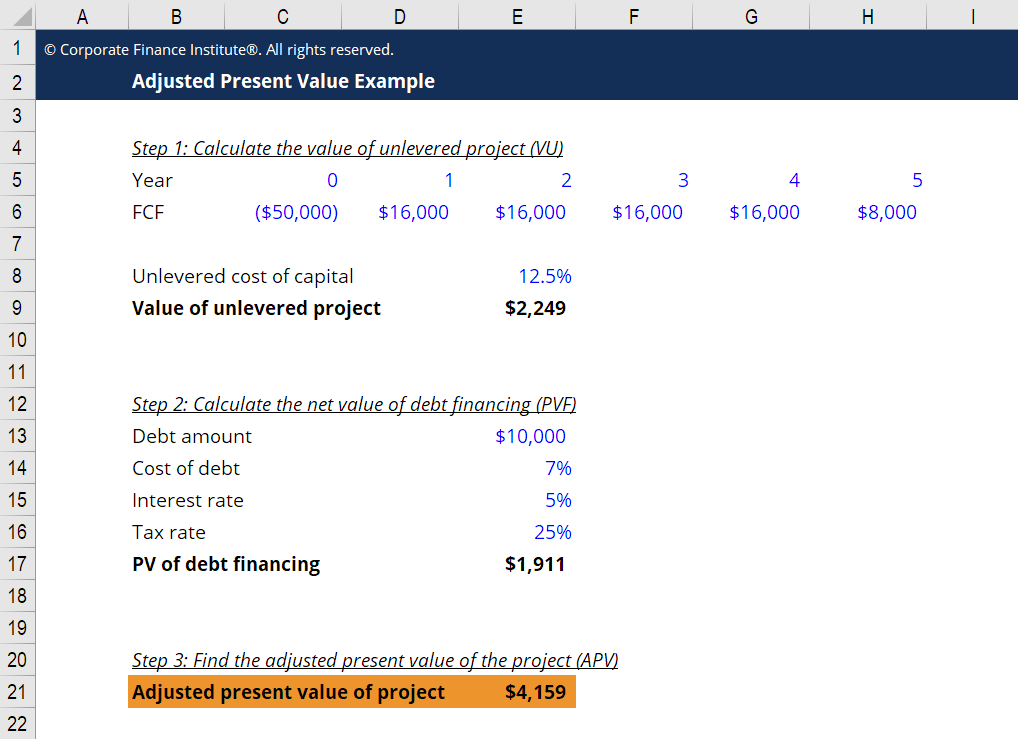

Tax Shield Deduction x Tax Rate. Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable. Adjusted Present Value - APV.

The tax shield computation is represented by the formula above. And this net effect is the loss of the tax shield. The value can be calculated by the interest expense multiplied by the companys tax rate.

The aim of the chapter is to identify and define the well-known approaches associated. Tax_shield Interest Tax_rate. Suppose company X owes 20m of taxes pays 5m.

The interest tax shield is an important consideration because interest expense on debt ie. If you wish to calculate tax shield value manually you should use the formula below. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

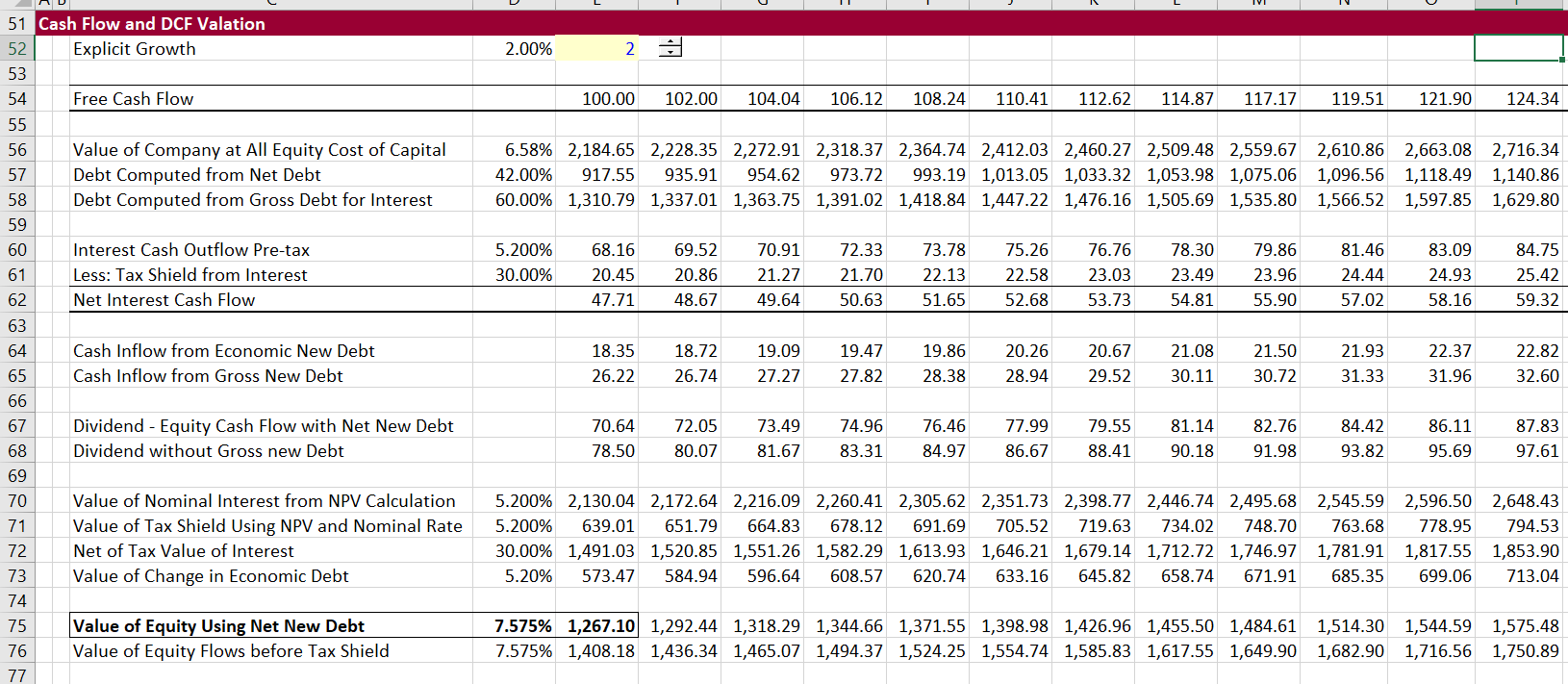

However adding back the protection is not straightforward because we need to consider the net effect of losing a tax shield. This is usually the deduction multiplied by the tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation.

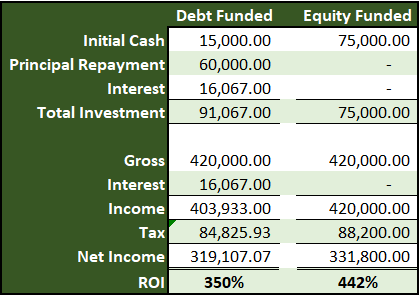

To calculate the value of the interest tax. Now lets look at the impact that having debt has on the organizations Income. The effect of a tax shield can be determined using a formula.

The cost of borrowing is tax-deductible which reduces the taxes due in the current period. Due to the existence of tax-deductible expenses a tax advantage called tax shield arises. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a. To learn more launch. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

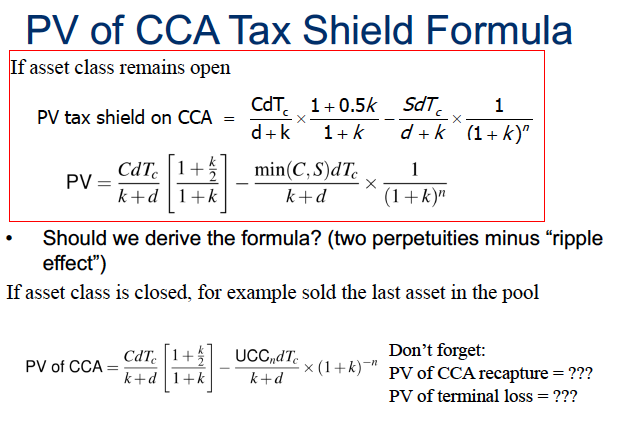

The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any.

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Cima Spreadsheet Skills Debt Sculpting

Tax Shield Calculator Efinancemanagement

Depreciation Tax Shield Formula Examples How To Calculate

Solved 25 Compute The Present Value Of Interest Tax Shields Generated By These Three Debt Issues Consider Corporate Taxes Only The Marginal Corp Course Hero

Tax Shield Meaning Importance Calculation And More

Edit This Is All The Information Provided It Is Chegg Com

How Much Should A Firm Borrow Ppt Video Online Download

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tough Outdoor Supplies Is Looking To Expand Its Chegg Com

How Tax Shields Work For Small Businesses In 2022

Chapter 10 Making Capital Investment Decisions Prepared By

Depreciation Tax Shield Formula And Calculator

Solved An Asset Has An Installed Cost Of 1 Million A Life Of 8 Years A Course Hero

Adjusted Present Value Apv Definition Explanation Examples

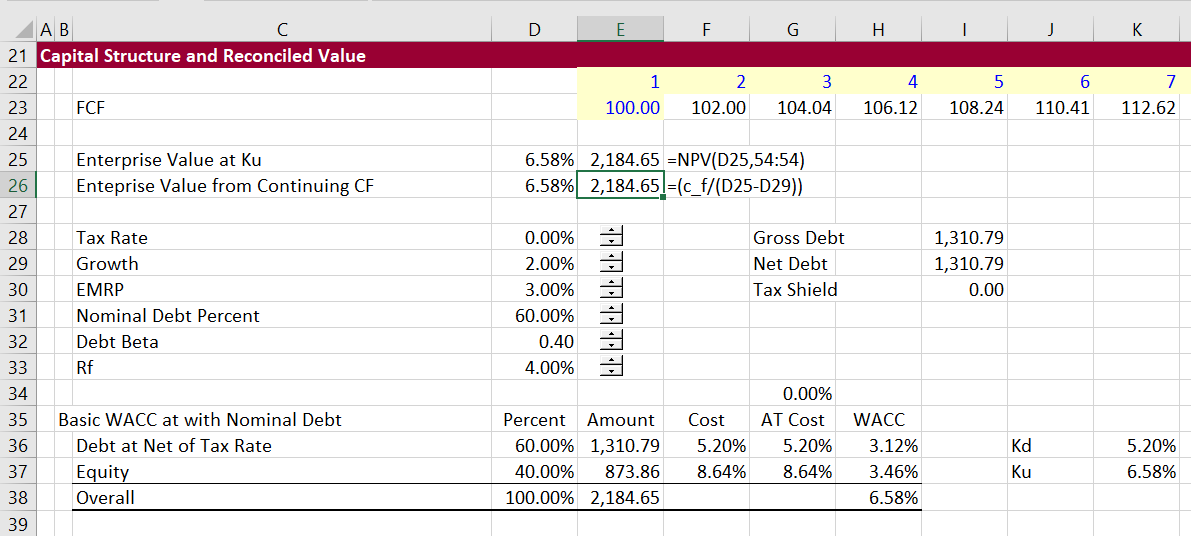

Proof Of Valuation Using Ku Or Wacc Without Interest Tax Shield Edward Bodmer Project And Corporate Finance

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)